A landmark achievement

On 27 September 2007, the Chairman of the Board of Trustees of the National Empowerment Fund, Mr Ronnie Ntuli, and the Chief Executive Officer of the NEF, Ms Philisiwe Buthelezi, announced the share allocation of the landmark NEF ASONGE share scheme at a press conference in Johannesburg, following the sale of more than 12 million MTN shares in a milestone empowerment initiative.

Oversubscribed by 13%

Over 87 000 people participated in ASONGE, resulting in a substantial 13% oversubscription of the offer. The NEF had allocated an initial 10.64 million MTN ordinary shares to Black individuals and savings and/or investment groups, which were worth R1,14 billion on the day of the an- nouncement of allocation results on 27 September 2007.

The Board of Trustees of the NEF approved a further alloca- tion of 1,4 million shares, worth R147 million, in order to provide for the over-subscription and to ensure a full alloca- tion of shares to qualifying applicants, therefore R1.3 billion worth of MTN shares were transferred through ASONGE, and at the time of writing, investors are already significantly in the money.

All valid applications within the allocation value thresholds received the full allocation.

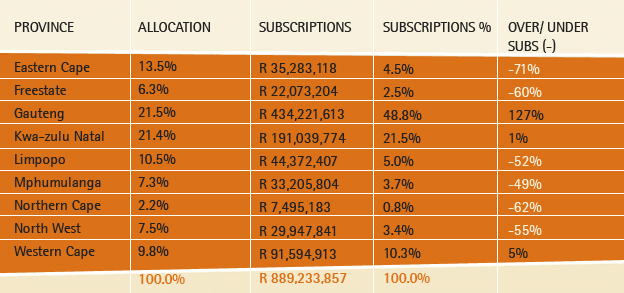

Provincial breakdown

An allocation plan was compiled based on population statistics to ensure each province was assured of an equitable opportunity to subscribe for shares. Marketing and communication campaigning in each province supported this provincial focus. Despite this, there were provinces with an under-subscription and these provinces saw their allocation transferred proportionately to the over-subscribing provinces to cater for the demand and investor provincial migration dynamics.

All provinces participated to the best of their capacities. However, those provinces which undersubscribed did so be- cause of reasons and factors relating to savings levels and investment capacity, as well as provincial GDP (Gross Domestic Product) dynamics. Through educational roadshows to all provinces, extensive marketing and direct interaction with investment groups across the country, the NEF took de- liberate and special care to ensure that no one province or set of provinces benefited at the expense of other provinces because the NEF’s mandate as an agency of the dtic is to pro- mote Black economic participation throughout the country.

Below is a breakdown of the provincial share allocation:

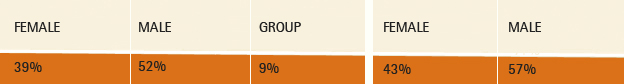

A breakthrough of women shareholders

By value, 39% of the shareholders are women, holding a total 4 681 124 shares, while Black males hold 52% of the shares, or a total 6 209 627. Savings and investment groups, which comprise stokvels, burial societies, trusts, co-operatives, church savings groups and others, together hold 9% of the shares, or a total 1 125 307 shares. The gender split was 43% Female, 57% Male by value, and 49% Female, 51% Male by number of applicants, demonstrating a high level of interest from women despite affordability constraints.

The figure below illustrates the breakdown of the ASONGE share allocation by value:

Communication with shareholders

From 29 September 2007, ASONGE investors began receiving a welcome pack comprising a letter from the Board Chairman and the CEO of the NEF, a Participation Certificate and an Allocation Statement, which they are urged to “read and store safely and securely”.

Dividends

If dividends are declared by MTN at any stage during the full investment period the dividend amount will be paid directly to investors, who are entitled to attend and vote at any of the MTN shareholder and general meetings.

Bonus shares

In accordance with the rules, investors are not permitted to sell their shares during the minimum investment period, which is the first 12 months from the date of the allocation, but enjoy unencumbered economic interest during this period.

Investors who hold the MTN ordinary shares for the full investment period of 24 months from the date of allocation, will receive 1 bonus share for every 10 MTN shares held.

Message from MTN

“The MTN Group welcomes the announcement regarding the allocation of the NEF’s MTN shares to ASONGE share scheme investors. We believe the ASONGE investors will enhance the BEE equity ownership in MTN and we welcome our new shareholders.” – Issued by MTN Group Corporate Affairs on 27 September 2007.

A summary of exceptional results

- ASONGE oversubscribed by 13%.

- The offer has met existing public demand and sets a historic landmark for future share offers.

- Over 12 million MTN shares worth R1.3 billion sold to Black investors.

- Over 87 000 Black investors now own shares in a blue-chip company.

- ASONGE has contributed to a growing culture of Saving and Investment amongst Black people.

- Women shareholders = 49% by number, 39% by value (overall). 51% by number and 43% by value (within individuals).

- In alignment with the targets set by BB BEE Codes of Good Practice.

- All provinces were allocated shares and involved in the marketing campaign to enable participation to their full capacity.

- Unencumbered economic benefit is fully vested in Black hands.

- Through the NEF, Government is fulfilling a critical national imperative, which is to grow Black economic participation.